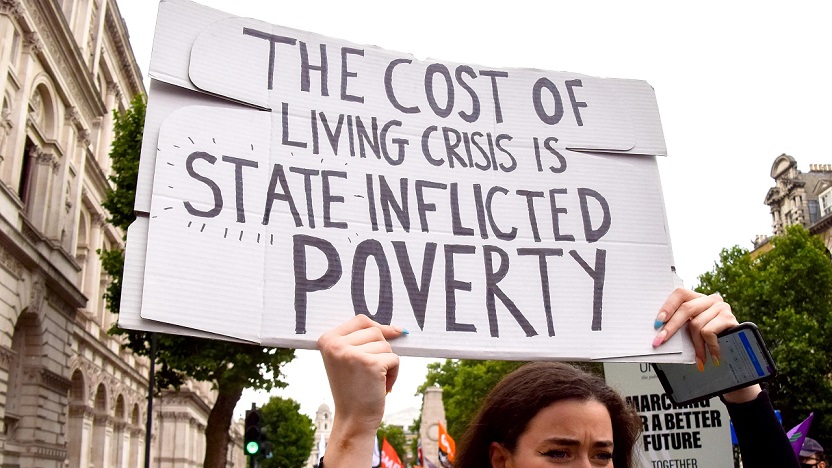

LONDON, UK: According to a famend thinktank, Resolution Foundation, UK households are solely midway through a two-year cost of living crisis, and common salaries are set to drop by greater than £2,000 as a result.

The cost of living disaster which, when mixed with a tough recession, will leave households worse off than they were earlier than the pandemic, a brand new report out today reveals.

The warning comes amid a rash of strikes by workers demanding pay rises nearer to the common inflation rate of 10.7%.

A vote by teachers is anticipated to again strike motion when the ballot outcomes are introduced over the subsequent fortnight, including greater than 500,000 public sector workers to a tally that features nurses, Whitehall civil servants and Border Force staff.

The thinktank said that whereas the headline rate of inflation was likely to fall over the approaching months in response to tumbling worldwide gas and petrol prices, the price of living would nonetheless stay cripplingly excessive for a lot of households.

Energy bills are anticipated to extend after “the slimming down of presidency support”, pushing the typical energy invoice to rise from £2,000 in 2022-23 to £2,850 in 2023-24.

The drop within the price of wholesale gas is probably going to reduce the cost to the Treasury of presidency energy subsidies directed at companies and households, however longer-term contracts covering the provide of gas to households are anticipated to maintain retail prices excessive for at least the remainder of the year.

A freeze on income tax thresholds will additionally increase tax funds for a middle-income family by round £700 from April, whereas rising mortgage prices will result in a 12% fall in actual incomes over a two-year interval for the 3m households forced to refinance their mortgage loans.

Middle income and poorer households’ monetary wealth tends to decrease than richer families, meaning they’re set to shoulder a comparatively bigger hit from the price of living crisis.

Rishi Sunak and Chancellor Jeremy Hunt’s £55bn worth of tax hikes and spending cuts final November will leave common Brits’ poorer, as will the government’s rolling again of energy invoice support from April and better mortgage rates.

But, the federal authorities signing off on a series of one-off funds to poorer families, uprating advantages by over 10 per cent and the energy invoice price cap has averted a living requirements catastrophe, the report said.

Child poverty charges are likely to extend markedly in 2023 as a outcomes of these factors, the Foundation said.